who claims child on taxes with 50/50 custody pennsylvania

In cases of 5050 custody this can and. It is the parent who spends the most.

Child Support Reform Promotes Involvement Closes Pay Gap

But if the custody agreement.

. Transferring Tax Credit to Your Ex in a 5050 Custody Arrangement. Having a child may entitle you to certain deductions and credits on your yearly tax return. In the event of.

But if you dont suspect anyone who could have claimed the dependent your dependent may be a victim of tax identity theft. For a confidential consultation with an experienced child custody lawyer in Dallas. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

Who Claims Child On Taxes With 50 50 Custody. By Aaron Weems on November 1 2012. In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns.

Is there such a thing as 50 50. If only one of you is the childs parent the child is treated as the qualifying child of the parent. This can lead to some confusion over whether either.

In the event of a 5050 custody schedule child support in Pennsylvania is payable to the parent with the lower income by the parent with the higher income. When you have 5050 custody who claims the child on taxes. Who Claims the Child With 5050 Parenting Time.

Who Claims a Child on US Taxes With 5050 Custody. Again the rule for claiming children on your taxes is relatively simple. When both parents claim the child the IRS will usually allow the claim for the parent that the child lived with the most during the year.

Child Custody and Taxes. But if the father furnishes over 50 of the childs support he is entitled to the. However if the child custody agreement is 5050 the IRS allows the parent with the.

March 8 2021 To finish our FAQ series we will cover questions that overlap with the firms other areas of practice. The court has ruled joint. California law states that in split 5050 child custody agreements the parent with the higher income can claim the.

Tax issues are an important component of equitable distribution cases and the Pennsylvania support code specifically allows the Court to. He lives with both 50 of the time. Who claims child on taxes with 50 50 custody in PA.

By Fox Rothschild LLP on January 23 2008. The Internal Revenue Service IRS typically. You who can claim a child ontaxes in a 5050 custody - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

Once it has been determined. Please beware that if the custodial parent releases the exception the custodial parent may not claim the Child Tax Credit. Merlo Accountant replied 12 years ago.

Who claims child on taxes with 5050 custody pennsylvania. Pennsylvania allows for parents to share custody of a minor child after a divorce and in some cases that custody is split equally 5050. Even still the IRS policy remains.

Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as. By continuing to use. How the IRS Decides Who.

Hello again mkhPA follows the same rulesas the IRS for claiming a dependent. Section 152 This usually means the mother because she most often gets primary physical custody. Who Gets to Claim the Child on Taxes With 5050 Custody.

The parent who has the majority of overnights in a given year gets to claim the children on their taxes. Generally Pennsylvania law provides that the parent who has primary physical custody of the child is entitled to claim the. Typically the parent who has custody of the child for more time gets to claim the credit.

The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

Divorce In California How Long Do I Have To Be Married To Get Half Of Everything

Do I Have To Pay Child Support If I Share 50 50 Custody

What Happens When Both Parents Claim A Child On A Tax Return Turbotax Tax Tips Videos

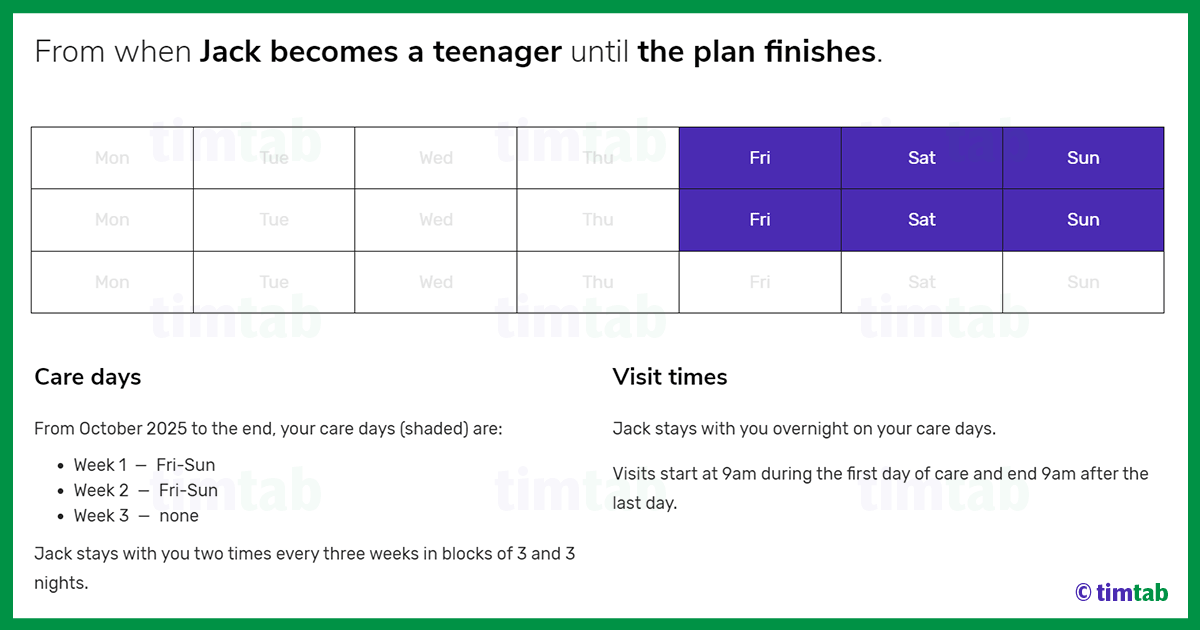

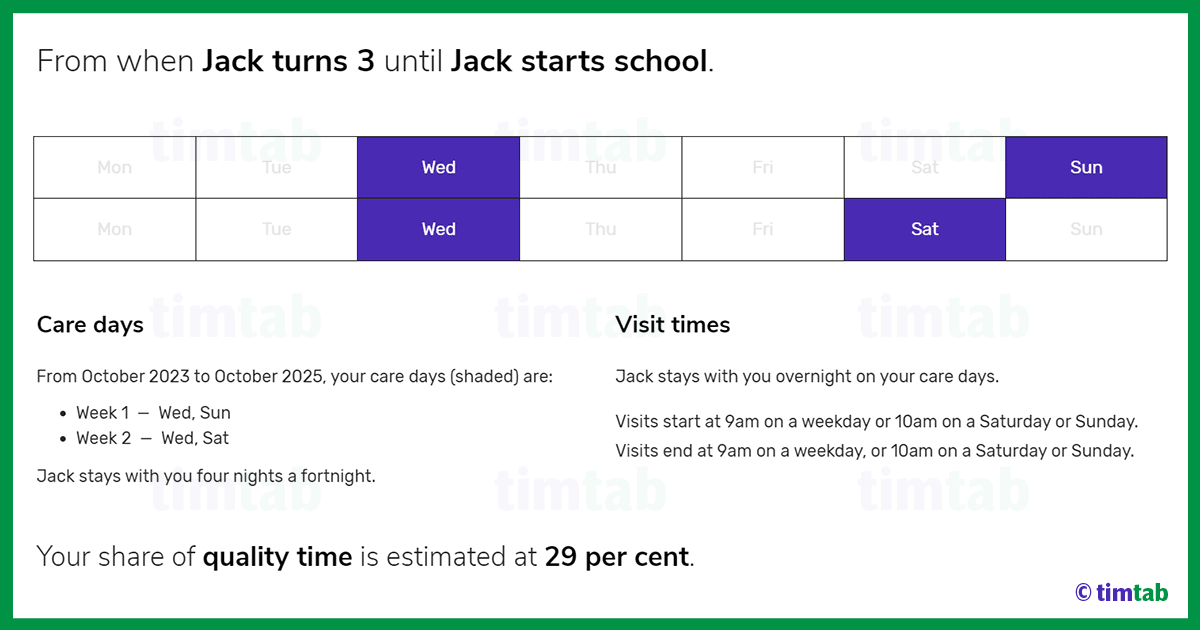

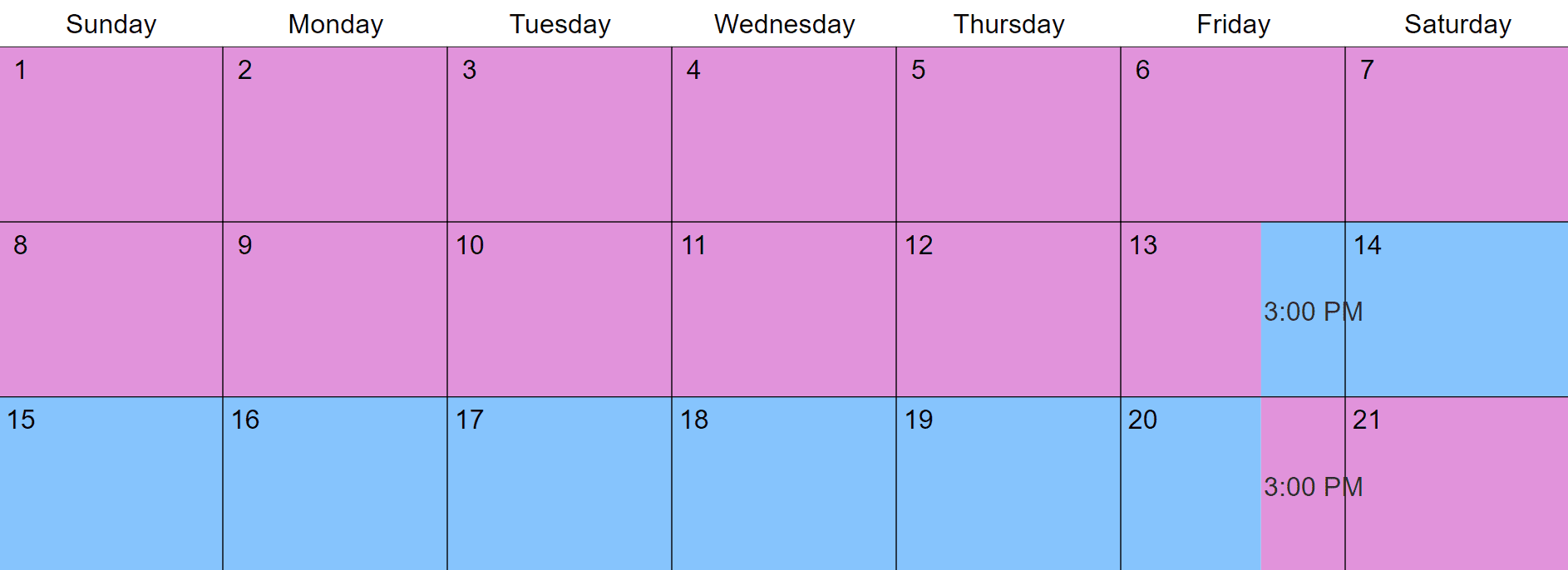

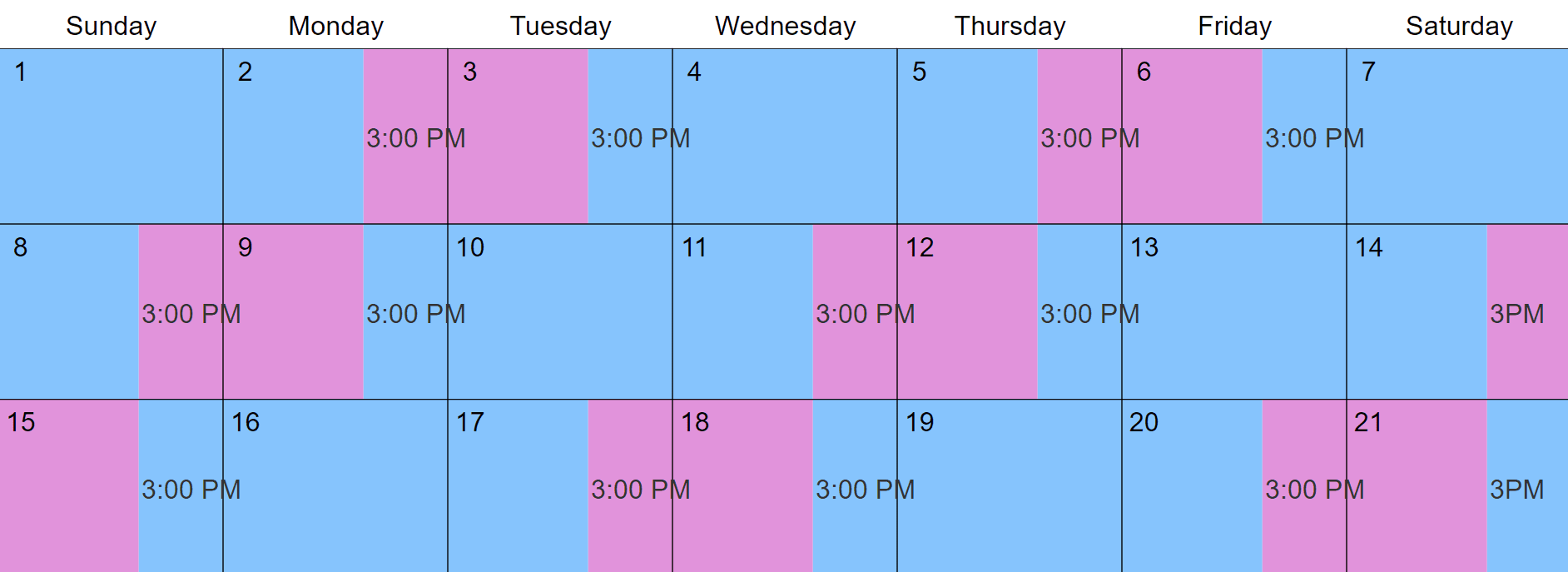

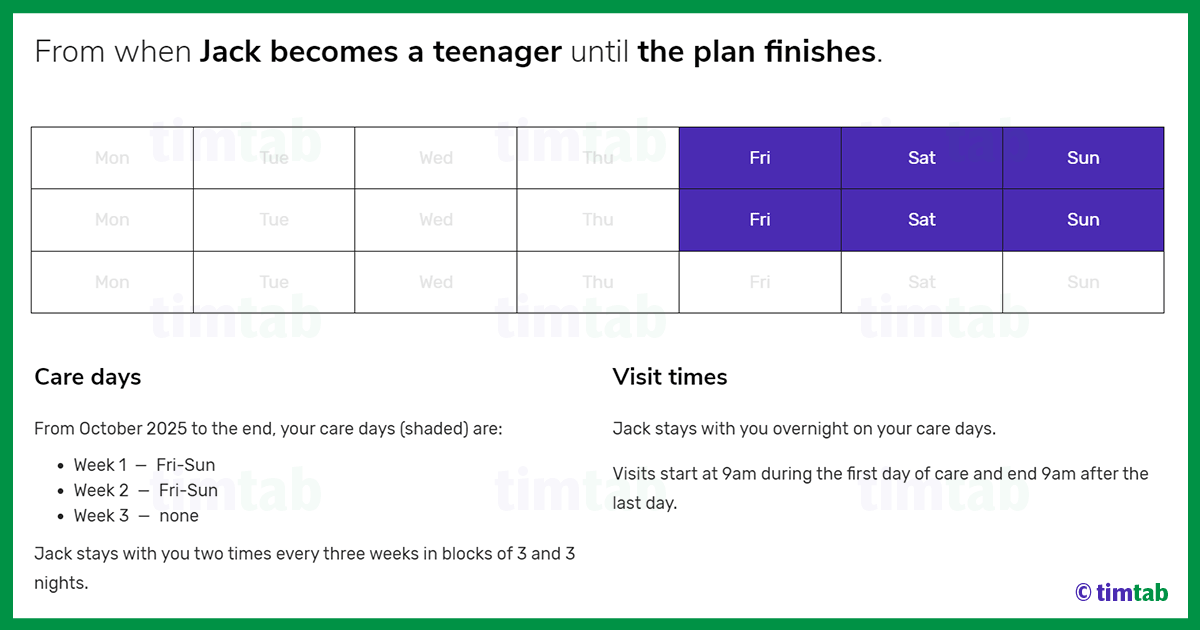

70 30 Child Custody Schedules Top 4 Plans Timtab

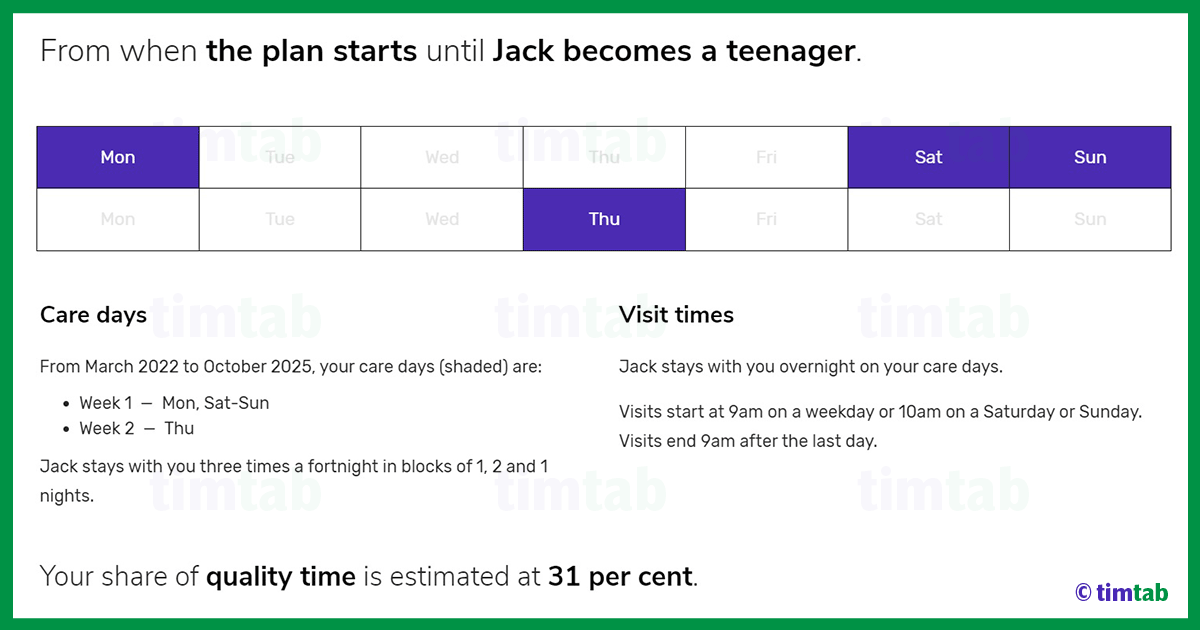

70 30 Custody Visitation Schedules Most Common Examples

70 30 Custody Visitation Schedules Most Common Examples

Child Custody In Pennsylvania Which Agreement Is Right For You

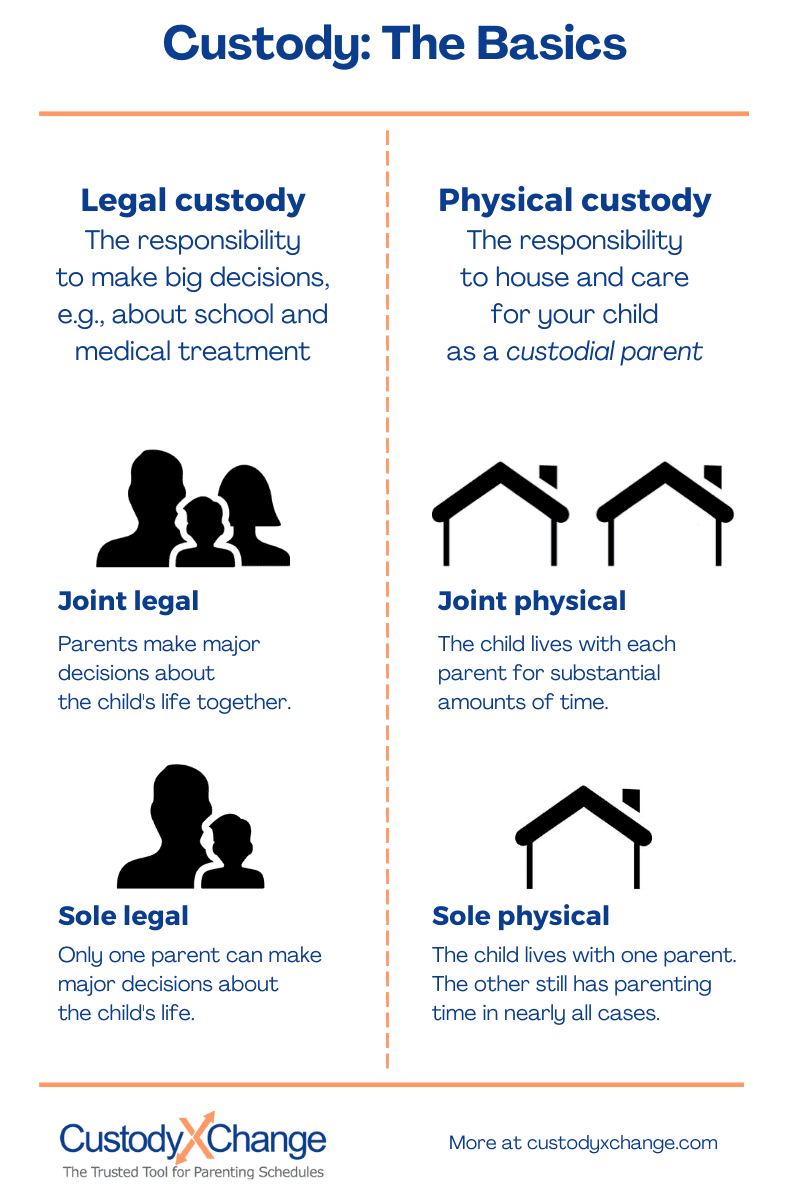

Joint Legal Custody Defined Advantages Disadvantages

Who Claims A Child On Taxes With 50 50 Custody In California Her Lawyer

.png)

Is Property Split 50 50 In A California Divorce

70 30 Child Custody Schedules Top 4 Plans Timtab

Who Claims The Child With 50 50 Parenting Time Equal Griffiths Law

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

70 30 Child Custody Schedules Top 4 Plans Timtab

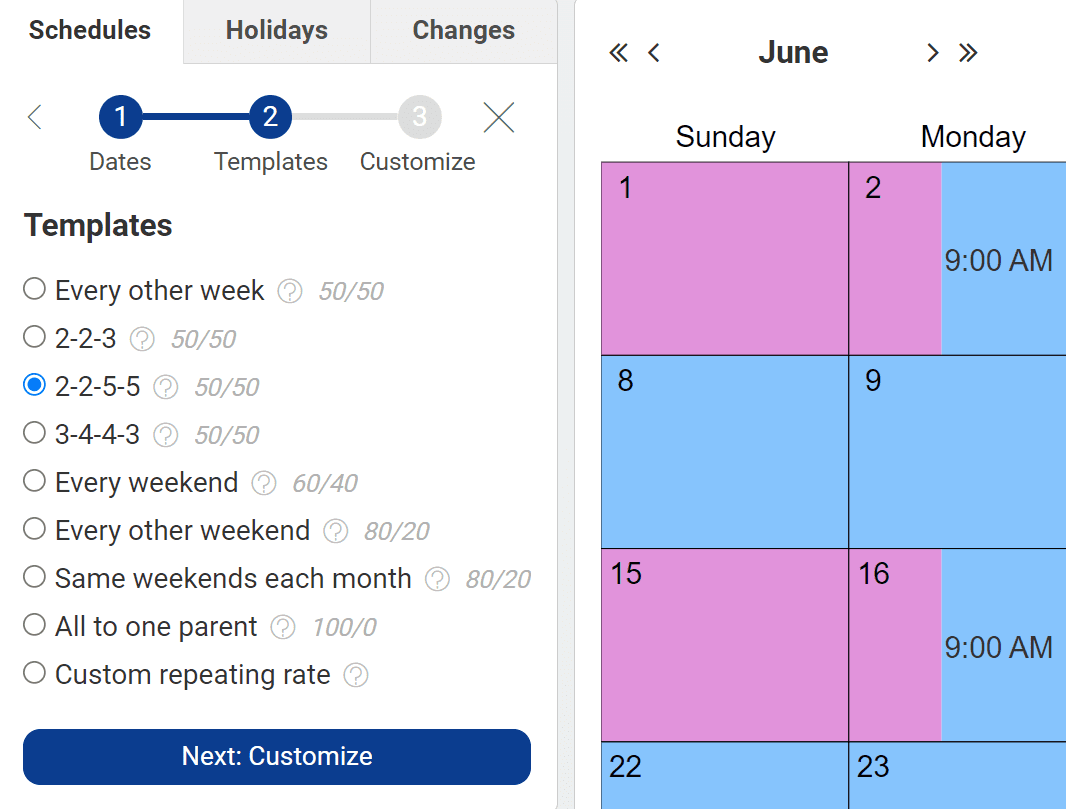

How To Create The Perfect Parenting Agreement With Examples

70 30 Custody Visitation Schedules Most Common Examples

Do I Have To Pay Child Support If I Share 50 50 Custody